Reading Red will always be a free publication, but if you’d like to support me and my work, please consider a paid subscription. 🍒

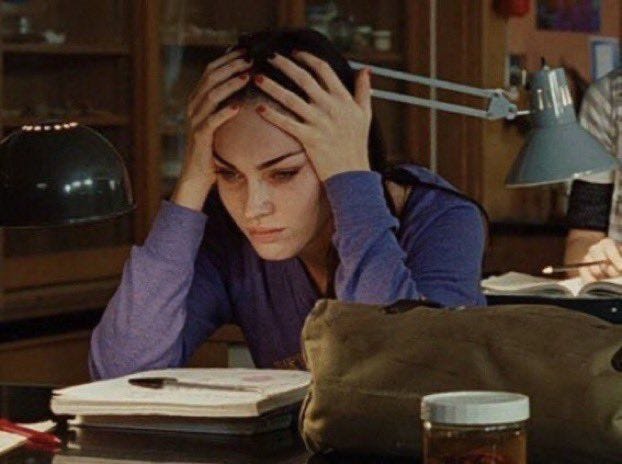

I pass two or three schools on my way to work in the morning. The spectrum of kids, from apathetic to academic, stroll through the crosswalks and into the halls. But is what they learn really useful? I am not jumping the gun into homeschooling, anti-vaxx, anti-science area — please, think better of me — although I do question why kids are spending hours in K-12 learning advanced calculus but not nutrition. Why not how to fill out taxes? Calculus is important, yes, but it is not a skill I’ve had to access in ten years whereas food and taxes are embedded in my daily life. We dissect frogs with precision, yet many of us can’t dissect our monthly spending habits. We can titrate chemicals in beakers, but we can’t titrate our reliance on AI answers or parents’ purse strings. In our capitalistic world, ignorance is lucrative. As long as there’s profit from confusion, life skills will remain scarce electives rather than core curriculums.

Public schools are, at their heart, institutions designed to prepare us for “society” (insert Joker picture here). Yet, their definition of preparedness often leans heavily on test scores, standardized metrics, and the ability to excel in a workforce that benefits more from worker compliance than worker autonomy.

The emphasis on standardized testing, particularly following the No Child Left Behind Act, has led schools to cut back on subjects like physical education and nutrition, further marginalizing health education. One significant issue is the placement of nutrition education under the jurisdiction of the U.S. Department of Agriculture (USDA). The USDA has a dual mandate: promote agricultural products and regulate food safety. This conflict of interest has led curriculums to prioritize industry interests over public health.

The USDA's involvement in creating the Food Pyramid resulted in guidelines that favored agricultural producers, often at the expense of nutritional accuracy. Aside from the conflicting motivations from the USDA, data used to support current nutrition education is flawed if not fully discredited. For example, former Cornell researcher Brian Wansink’s work on eating behavior was widely disseminated, despite methodological issues. His research influenced school lunch programs and public perceptions of healthy eating, but many of his findings were later discredited due to data manipulation and questionable research practices.

Public health campaigns — like the Food Pyramid or the President’s fitness test — project adult anxieties about weight onto children, leading to programs that promote body dissatisfaction and disordered eating. Initiatives aimed at reducing childhood obesity sometimes send conflicting messages about body image and health, causing more harm than good. The oversimplification of concepts like calorie counting also plague school curriculums. The hosts argue that such approaches fail to account for the complex interplay of metabolism, genetics, and social factors in weight management. They highlight how the "calories in, calories out" model can perpetuate anti-fat bias and ignore the nuanced realities of individual health.

For more on how Gen Z/Gen Alpha are handling this (hint: not well), I highly suggest Morgan’s piece:

And nutrition isn’t the only sphere falling to the wayside. Despite the need, many schools offer little to no formal personal finance instruction. US governmental surveys find the majority of states only recently began requiring financial literacy courses. In 2024, 35 states now mandate a high-school personal finance class for graduation. Although, as of 2024 Colorado, Massachusetts, and Washington require neither a personal finance nor an economics course for graduation.

Young people struggling with emergency costs — and there are MANY struggling — often turn to high-interest payday loans. These loans typically charge annual rates of 300% or more. Studies show these trap borrowers in debt cycles with 75% of payday loans going to people taking out 10 or more loans per year. That is a payday loan nearly every other paycheck! 6% of those aged 18–24 are already behind on card payments, incurring steep interest. Student loans (now ~$1.7 trillion for 43 million borrowers) further strip young people of money and opportunities. Private loan companies and servicers have been found misrepresenting terms and denying relief to unknowing borrowers, leading to lower credit scores that make future borrowing costlier, if not impossible.

Political and economic interests, not surprisingly, also play a role. Critics note that many “financial literacy” programs are sponsored by corporate groups (the U.S. Chamber of Commerce, financial firms, etc.) and teach a free-market, pro-Capitalist, individual-responsibility perspective. Such curricula blame the individual for financial problems, rather than addressing systemic issues or predatory practices. Individual blame then leads to shame and the notion that “I just need to work harder” — a thought that makes billionaires cream in their pants. No, chattel slavery did not contribute to economic inequality, silly, it’s all your own fault! Financial education, as currently promoted, serves to protect the capitalist incentive structures that favor continued consumer borrowing: banks and lenders earn from every loan, while there is little profit motive for society to ensure borrowers truly understand what they owe.

In a system where revenue and profit margins are built on keeping us in the dark, why teach us empowerment? Better to keep us signing up for “quick-fix” meal plans or subscriptions, scrambling to figure out how to properly file taxes, or stuck in cycles of debt that banks and credit agencies quietly collect from.

Yo I thought dissecting frogs was just in movies is that real!!!? Is it real bam??!